What is the Pension Benefit Guaranty Corporation?

Most pensions are insured by the Pension Benefit Guaranty Corporation (PBGC). The PBGC insures the retirement benefits of around 31 million American workers in around 24,500 pension plans. The single-employer program protects around 20.6 million of these American workers.

The PBGC was created by the Employee Retirement Income Security Act of 1974 to encourage the continuation and maintenance of defined benefit pension plans, provide timely and uninterrupted payment of pension benefits, and keep pension insurance premiums at a minimum.

Although the PBGC insures most defined benefit plans, some are not covered. For example, plans offered by “professional service employers” (such as doctors and lawyers) with fewer than 26 employees, by church groups, or by federal, state or local governments usually are not insured.

How is the PBGC funded?

The PBGC is not funded by general tax revenues. The PBGC collects insurance premiums from employers that sponsor insured pension plans, earns money from investments and receives funds from pension plans it takes over.

Are there any limits on the pension amount participants will receive?

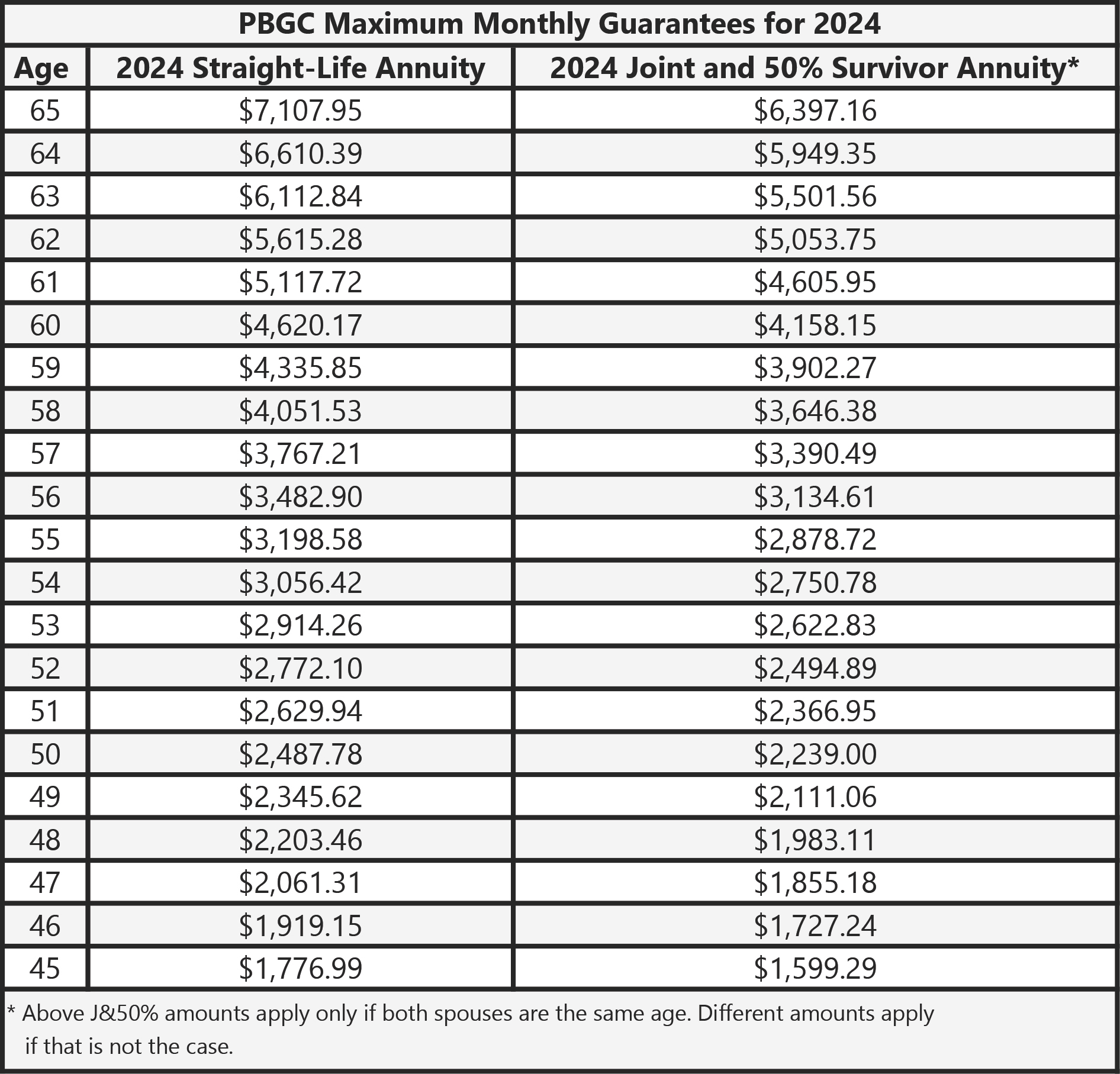

For plans ending in 2024, workers who retire at age 65 can receive up to $7,107.95 a month ($85,295.40 a year). The guarantee is lower for those who retire early or when there is a benefit for a survivor. The guarantee is increased for those who retire after age 65.

How are pension plans terminated?

1 - The employer can end the plan in a standard termination but only after showing the PBGC that the plan has enough money to pay all benefits owed to participants. The plan must either purchase an annuity from an insurance company (which will provide you with lifetime benefits when you retire) or, if your plan allows, issue one lump-sum payment that covers your entire benefit.

2 - If the plan is not fully funded, the employer may apply for a distress termination if the employer is in financial distress. To do so, however, the employer must prove to a bankruptcy court or to the PBGC that the employer cannot remain in business unless the plan is terminated.

When will my employer notify me of a plan termination?

If your employer wants to end the plan, your plan administrator must notify you in writing that your plan is ending. You must get this notice, called the Notice of Intent to Terminate, at least 60 days before the "termination" date. If the PBGC is terminating the plan, it will notify the plan administrator and often publish a notice about their action in local and national newspapers.

In a distress termination, or a termination initiated by the PBGC, the PBGC’s communication with you begins when it takes over your plan as trustee. Initially the PBGC will provide you with general information about the pension insurance program and its guarantees. The PBGC will be able to provide more specific information about your benefits after it has had an opportunity to review the plan’s records, assets, benefit liabilities, and your participation in the plan.

You cannot earn additional benefits after the plan ends.

How can I find out if my pension plan is underfunded?

- Your plan administrator is required to give you an annual written notice of the plan’s funded percentage and the limitations on the PBGC’s insurance guarantees.

- You also have a legal right to obtain information about your plan’s funding by requesting the information in writing from your plan administrator.

What does the PBGC guarantee?

The PBGC guarantees "basic benefits" earned before your plan's termination date, which include:

- Pension benefits at normal retirement age

- Most early retirement benefits

- Annuity benefits for survivors of plan participants

- Disability benefits for disabilities that occurred before the plan termination date

The PBGC does not guarantee:

- Health and welfare benefits

- Vacation pay

- Severance benefits

- Lump-sum death benefits for a death that occurs after the date the plan ended

- Disability benefits for a disability that occurs after the plan termination date

Legal Limits on the PBGC's guarantees

- Generally, the PBGC does not guarantee any monthly pension amount that is greater than the monthly benefit your plan would have provided if you had retired at your normal retirement age.

- The maximum amount that the PBGC guarantees is set each year under provisions of ERISA.

- If your plan was created or amended to increase benefits within five years before it ended, your benefits may not be fully guaranteed.

What happens if I’m already receiving a pension?

If you are already receiving a pension, the PBGC will continue paying you without interruption during their review. These payments, an estimate of the benefits that the PBGC can pay under the insurance program, may be less than you were receiving from your plan but will be paid in the annuity form you chose at retirement.

If you have not yet retired, the PBGC will pay you an estimated benefit when you become eligible and apply to the PBGC to begin payments.

What doesn’t the PBGC do?

The PBGC will not adjust your pension yearly to account for inflation.

Also, there is a limit on the combined amount you can receive from the PBGC's funds if you are entitled to benefits from more than one pension plan that the PBGC has taken over as trustee.

**For reference we have maintained the PBGC Monthly Maximum Guarantee table for the many Delphi Technologies employees whose pension plan terminated in 2009.

*Source: Pension Benefit Guaranty Corporation, 2008

Important Consumer Disclosures

Mainstay Capital Management, LLC is an investment advisor registered with the Securities and Exchange Commission. Due to various state regulations and filing requirements, Mainstay and its representatives may only provide investment advisory services in those states in which it is first appropriately registered or otherwise exempt or excluded from registration requirements. The purpose of this website is to provide the public with general information about the services offered by our investment management firm. Mainstay does not render personalized investment advice or services or effect, or attempt to effect any securities transactions, on this website. Our firm continuously monitors its filing requirements in all states, and will provide individualized advisory services only in accordance with various state regulations. Mainstay does not make any representations or warranties as to the accuracy, completeness, or relevance of any information prepared by any unaffiliated third party provider, whether linked to Mainstay's website or incorporated herein. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.